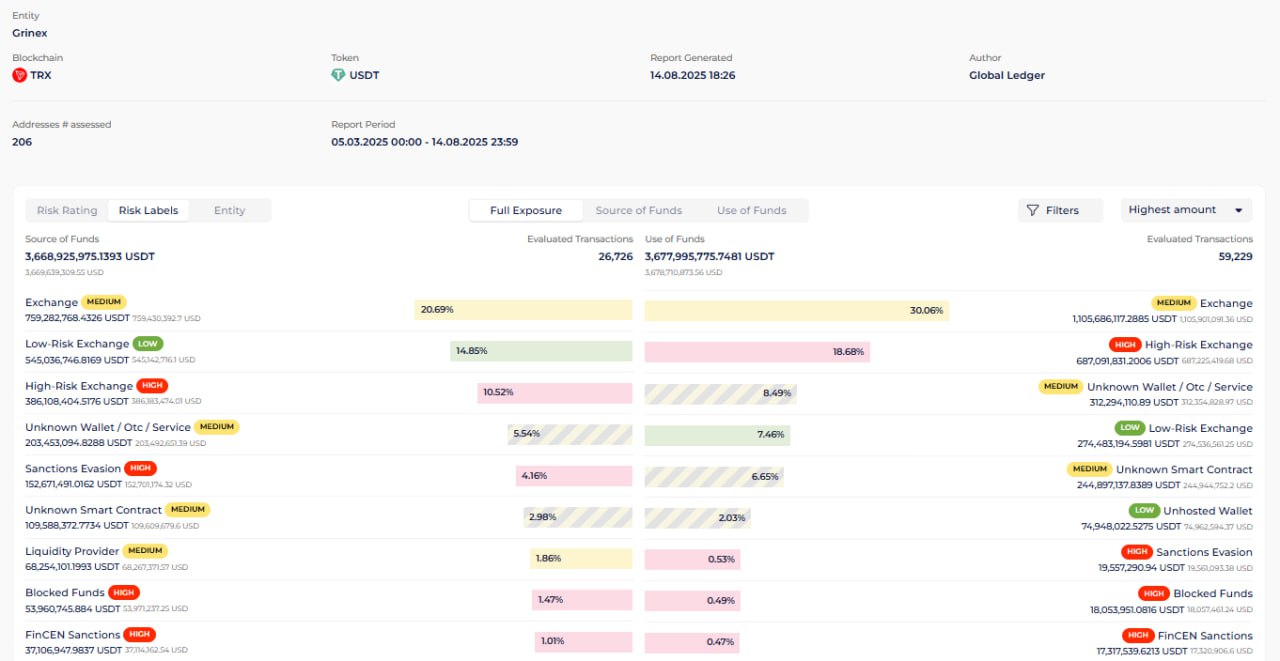

Grinex, sanctioned by OFAC on August 14, 2025, has processed ~7.3 billion USDT from from March 5 to August 14, according to the Global Ledger data.

As of today, Global Ledger has identified the following holdings in Grinex-linked wallets:

- 22,112.847582 TRX

- 6,888,148.788156 USDT

- 1,288,358,689.74 A7A5.

The OFAC list represents an important step in fighting sanctions evasion, but it does not capture the full picture. We have identified 312 wallets associated with Grinex, four of which, besides those listed by OFAC, are still active and hold a significant balance.

Due to our proprietary heuristics, we can detect newly created Grinex wallets and track transaction volumes, as well as the exposure of various centralized exchanges that handle deposits and withdrawals to and from Grinex. Some of these deposits are just one hop away from the newly-sanctioned entity.

Global Ledger has been closely tracking Grinex and A7A5 for months since March

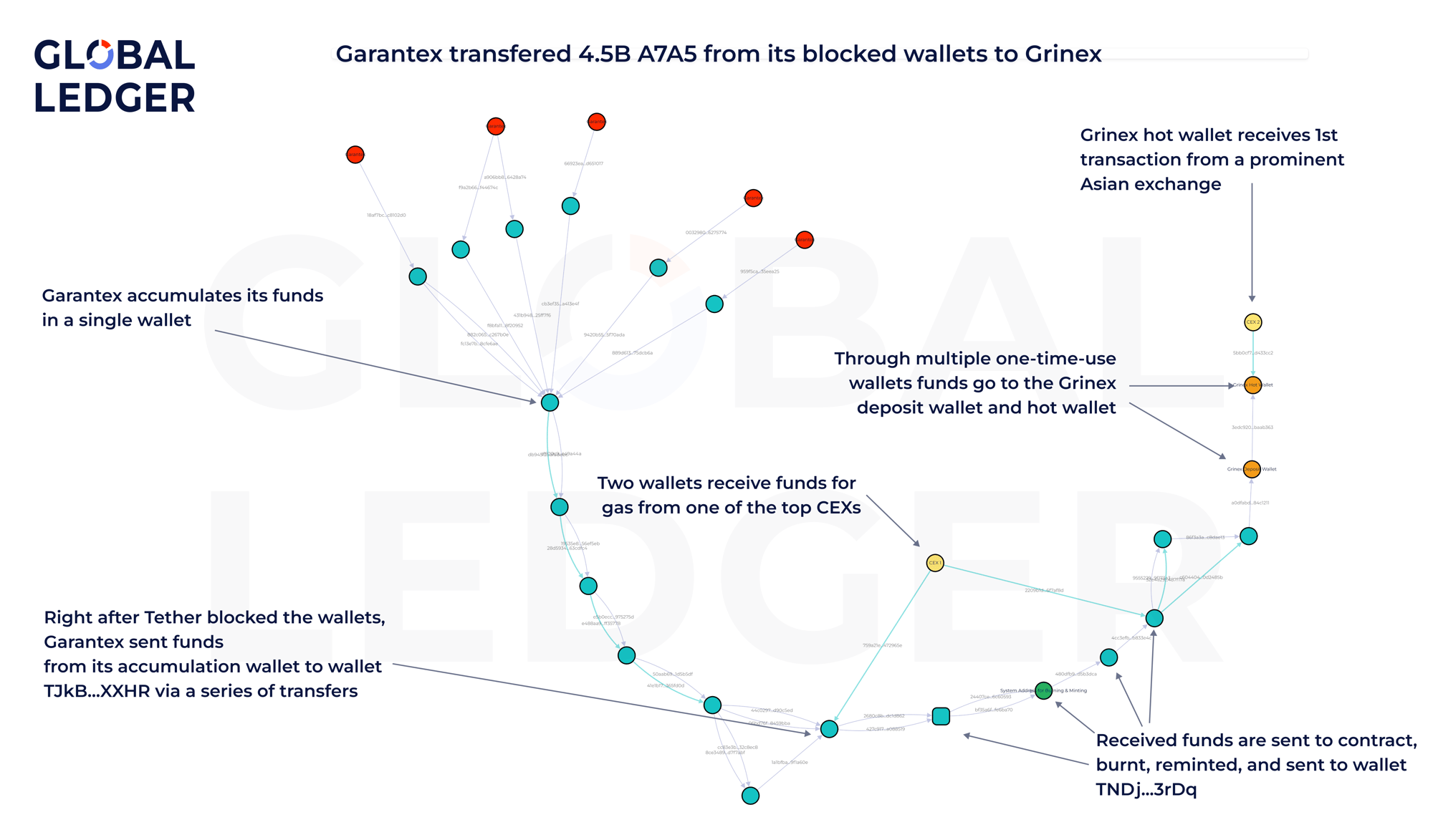

In March 2025, we’ve gathered evidence that Grinex, the exchange launched soon after the collapse of Garantex, is in fact a direct successor to Garantex, with liquidity and user balances transfers, promos, and even UI resemblance.

Our data showed that since the seizure of Garantex, Grinex’s transaction volumes have surged rapidly. In under two months, both incoming and outgoing transaction volumes have exceeded $1.2 billion each in USDT (Tron) alone (as of May 2025). During this research, we identified 180 exchanges that have engaged in direct or indirect transactions with wallets associated with Grinex, totalling $1.66 billion.

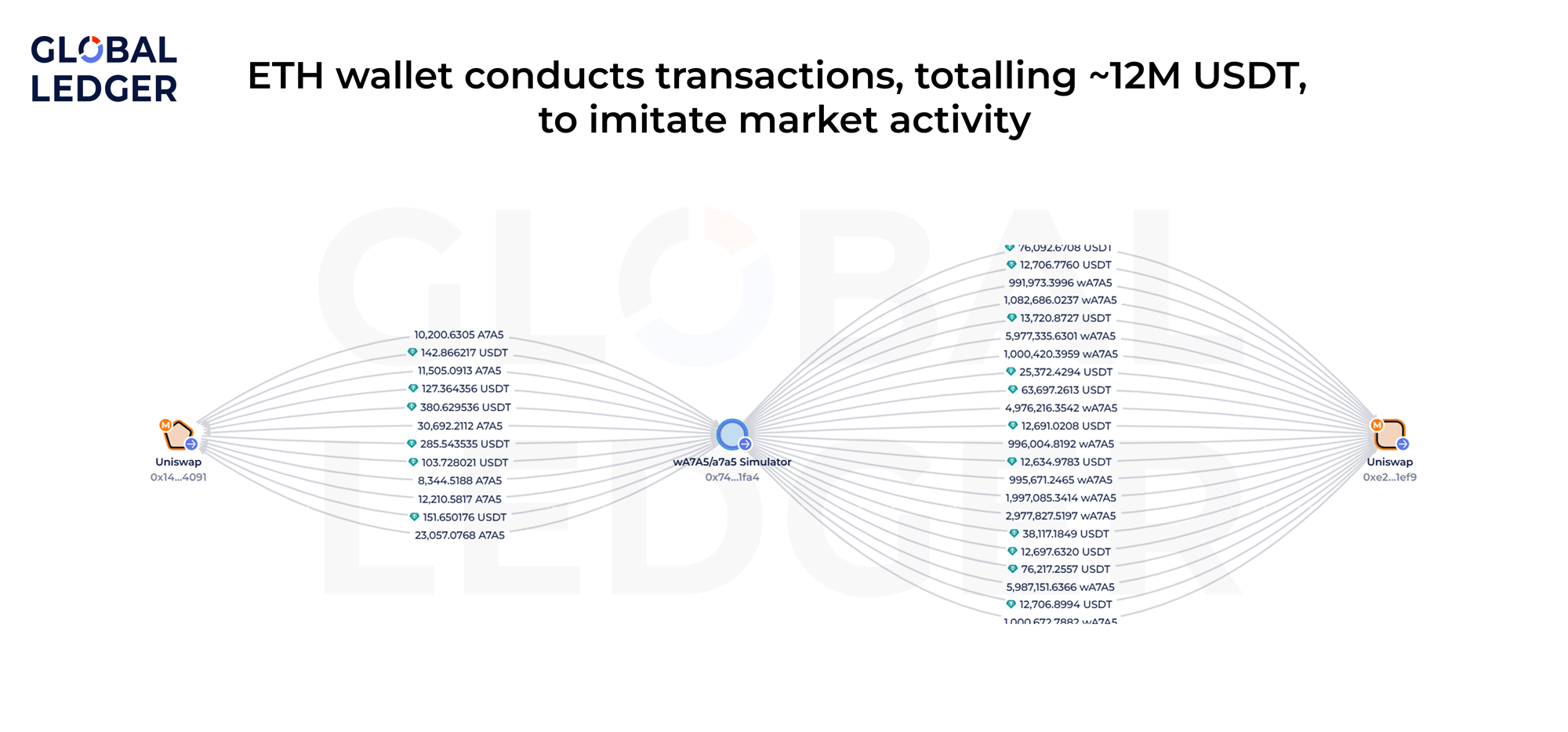

Wash trading is the main source of USDT liquidity for A7A5

We detected three Ethereum wallets constantly making direct transactions — buying and selling USDT and vice versa via pools. One of them has conducted 2,432 transactions involving the A7A5-USDT pool, and 2,665 transactions with the wA7A5-USDT pool, totalling approximately 12 million USDT.

On TRON, we observe a different pattern. The same wallets — often sharing gas providers — are draining USDT by swapping their A7A5 tokens through the project’s own smart contract, which makes those swaps quick and easy. USDT liquidity is consistently supplied by a recurring group of addresses, with funds originating from over 15 centralized exchanges with different risk profiles. These include both EU-licensed and non-EU platforms, as well as several operating under Russian or other international jurisdictions.

Announcements in their Telegram channels (both English and Russian) often precede or coincide with USDT infusions, presumably to attract new buyers. However, analysis shows that some wallets are already withdrawing USDT from the pool before such announcements are even made (even 1 minute before), suggesting a level of orchestration behind liquidity movements.

A7A5 activity often averages ~200 transactions per token cycle to make the asset look active and in demand

The project demonstrates consistent, though likely simulated, trading dynamics and continues to inject USDT liquidity, all while building its off-chain presence, focusing on brand growth, reputation, and official representation as a Kyrgyzstan-based company. Notably, at launch, key figures such as Leonid Shumakov were seen presenting from an office likely in Moscow-City, pitching A7A5 as a game-changer.

Unlike typical pump-and-dump schemes, A7A5 appears to be following a structured growth plan, leveraging both liquidity and marketing to position itself as a long-term player. If they continue along their current roadmap, the project’s viability may increase, especially if they achieve broader listings and formal partnerships.

Grinex’s Footprint in Global Exchanges: What the Flows Reveal

Grinex’s Footprint in Global Exchanges: What the Flows Reveal

Same Garantex, Different Sauce. “New” Russian Exchange Grinex Launched

Same Garantex, Different Sauce. “New” Russian Exchange Grinex Launched